How Long Does A Business Need To Keep Invoices

How Long Does A Business Need To Keep Invoices. If you own a business in the us, then it’s recommended that you keep business ledgers and key financial documents on file. These records include all sales documentation, business expenses, personal income, money paid into and withdrawn from the business, as well as vat and paye information if applicable.

Keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Freight bills and bills of lading:

For Example, If You Submit Your Records By January 31St 2022, You’ll.

How long you need to store it depends on the kind of expense and your tax filing status. Always keep receipts, bank statements, invoices, payroll records, and any other documentary evidence that supports an item of income, deduction, or credit shown on your tax return. How long business should keep invoices for there is no one answer to this question, however it is wise to keep invoices , receipts and records for 3 years.

In Most Cases, This Is Generally Three To Seven Years, Depending On The Circumstances.

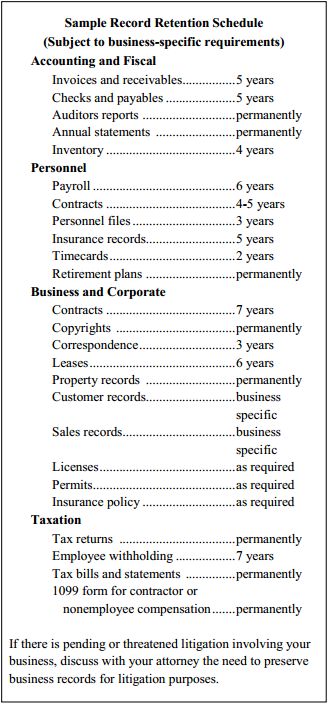

The retention periods for retaining a document depends on the category. Freight bills and bills of lading: If your business is not incorporated such as a sole proprietorship or a partnership, you will still need to keep your financial documents on hand for six to seven years in most countries.

Keep Records For 7 Years If You File A Claim For A Loss From.

During this period, tax records can be amended, changed or reviewed, and having a record of invoices would be required to support changes and claims. Once your customers have paid, you still need to keep a copy for a certain amount of time. Fixed asset records (invoices, canceled checks, depreciation schedules):

Here Are Some Quick Guidelines On How Long To.

How long should you keep business tax records? This summary is ordinarily made in your business books (for. (irs publication 583) here’s the breakdown of how long you need to store documents:

Sales To Customers/ Credit Memos:

These records include all sales documentation, business expenses, personal income, money paid into and withdrawn from the business, as well as vat and paye information if applicable. That alone should encourage you to attend to proper record keeping. This includes any accounting records such as invoices, purchase receipts, contracts, vat reports, balance sheets, paye records, etc.